Ideating New Ways to Engage

- Matt Adams

- Jun 22, 2023

- 3 min read

Updated: Jul 10, 2023

Now that we have a defined value prop, we need to better understand our segments' lures and hurdles. We wanted to identify which stages were most important to them and where our bank should emphasize new or evolved solutions.

Problem

Our bank saw lower-than-expected customer growth compared to competitors and a growing need to address attrition. There was an appetite from leadership to kickstart a new engagement model for the small-to-medium-sized business vertical of the bank.

Empathize

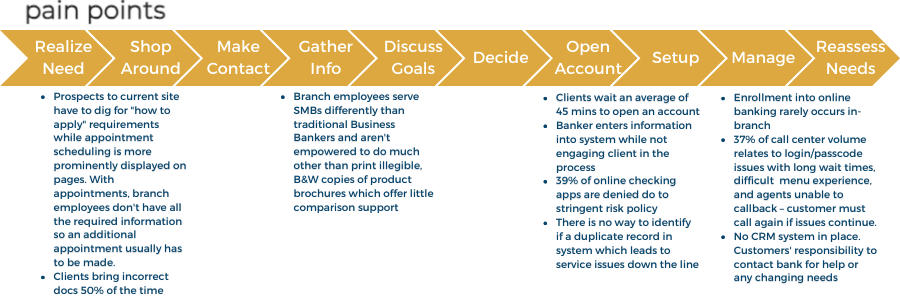

Using previously-sourced interviews, as a team, we needed to understand each aspect of the existing steps a prospect takes on their way to becoming a banking customer. From realizing they need to partner with a bank, to adding additional financial products, we aimed to articulate each phase in detail to simplify their experience.

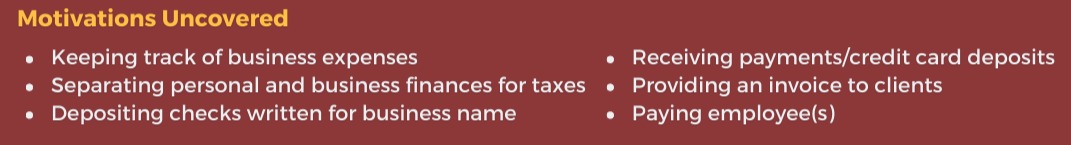

Speaking with customers about their distinct journeys, and the employees who served them, we uncovered the motivations driving them to a bank and the issues they ran into which potentially pushed others away.

Define

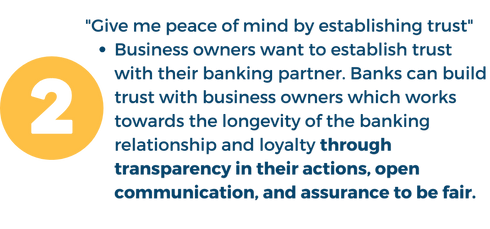

We collaborated to organize and distill these conversations into the four primary jobs to be done by a financial institution for a business owner. These will help guide our strategy and solutions in future sprints.

Ideate

With jobs defined, we set off to explore

With sprints dedicated to ideating, we connected with internal stakeholders and organized them around these four jobs to be done. With dedicated time to further explore those, as a team, believed to be most beneficial, we set out to expand on the best ideas to see how they could become a reality.

Prototype

Multi-Cultural Sprint

From our internal research and industry knowledge, we know minority entrepreneurs struggle the most in getting a business started. Yet, they're the largest population filing to open new businesses. We lead an ideation sprint dedicated to finding where our bank can support their process. In collaborating with our newly-formed multicultural teammates, we devised a realistic target customer and asked how the bank can better help get their business up and running.

After brainstorming, we voted on dedicating more time to think through two ideas. First, an in-person educational course to help aspiring entrepreneurs understand the different aspects of running a business. Second, a Shark Tank style pitch competition with prize money to help those aspirational owners get a jumpstart. In this time, we challenged the team to think of how these ideas truly hit on the jobs to be done. And if not, why should we proceed with them? Was there a way to add elements which highlight more than one Job?

Lead Routing Sprint

A major hurdle for internal partners was routing leads based on size, industry, and need. We explored a self-service lead routing tool that could follow a business owner from prospect to customer. We used a simple Problem/Solution matrix to define the potential platform and how it solves the problems uncovered in our research. Ideally, we'd use the information gathered in this platform to later inform other content and potential customer needs.

Test

Both of our Multi-Cultural prototypes were tested in the bank's home market, first. With in-branch marketing and partnerships with local colleges, dozens of people joined our weekly sessions and submitted applications for the pitch competition. Calling this a success, we launched another lab in Bridgeport, CT, and Harlem, NY. With these additional cities, we saw slower interest. Knowing these are larger metros, we put more emphasis on the pitch competition and raised the prize dollar amount. This seemed to have done the trick with dozens of participants and winners sharing their stories.

In planning, we uncovered tech resources to build that would be better utilized standing up the digital account opening platform. The lead routing prototype was shelved for an in-house build but we used a third party to create a white label version. After months of working with the vendor, the MVP was lackluster. In addition to low clicks from our sites, we weren't able to get in-platform data to measure success and where folks dropped off. After one year of use, and being unable to accurately calculate an ROI, we ended our relationship with the third party.

I read the post about ideating new ways to engage and thought it made a lot of sense how creativity needs space to grow and change when you least expect it. It made me think of a week I was so stressed with school that I had to pay someone to take real estate exam practice tests just to get my head straight and focus again and they helped me a lo. That taught me that finding calm and new ideas both take patience.