Prototyping Personalization

- Matt Adams

- Jun 22, 2023

- 3 min read

Updated: Jul 24, 2023

As a Marketing Manager for the bank, it was clear our technology and tactics did not align with 2020's standards. Using insights from our research, we set out to modernize our engagement model. We wanted tactics personalized to folks' unique stages of starting, growing, or running a business and bank employees empowered with the information to make those relationships easy to build and maintain. With our goal in mind, we created a business case to improve our enterprise tech stack to drive new customers to our bank. In doing so, we deepened our relationships with over 1,000 customers in the first half of the year.

Problem

Our bank saw lower-than-expected customer acquisition growth compared to competitors and a growing need to address attrition. There was leadership appetite to kickstart a new engagement model for the small-to-medium-sized business vertical of the bank.

Empathize

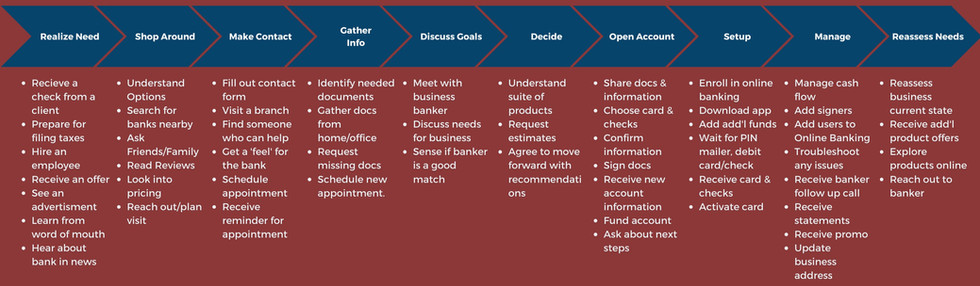

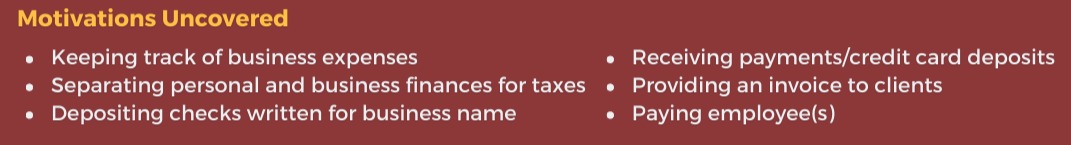

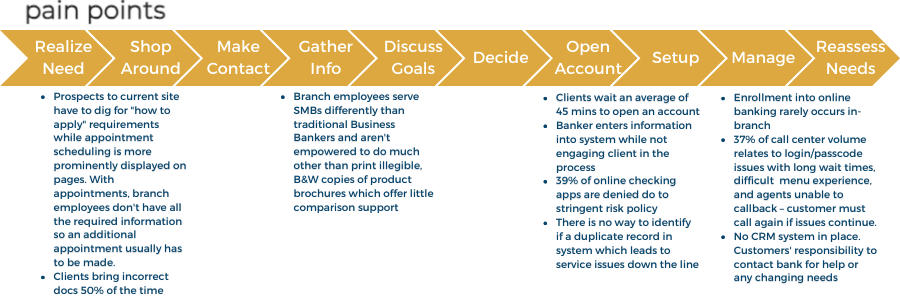

We conducted interviews with customers and the employees who served them about their distinct journeys. Here, we documented the current state of a business owner's relationship with a bank. Then, we uncovered the motivations driving them to a bank and the issues they ran into, potentially pushing others away. In the pain points, we discovered our existing digital solutions were difficult to enroll into, and our banking employee relationship was pivotal in our customer's long-term engagement with our brand.

Define

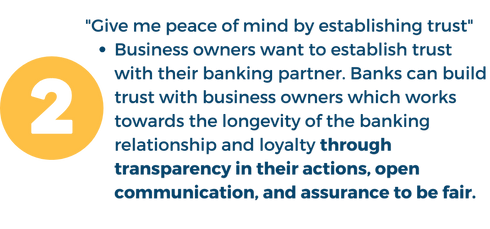

Our team then collaborated to organize and distill these conversations into the four primary jobs to be done. Answering the question: Why do small business owners choose our bank? These would help guide our strategy and solutions in future sprints.

Ideate

Knowing which jobs are most impactful for an aspiring customer, we collaborated with internal partners across different disciplines to brainstorm potential product solutions and organized them within the four jobs.

After brainstorming solutions worthy of dedicated time to explore further, we pitched a strategic concept: a feedback loop for aspiring entrepreneurs to explore different facets of starting and running a business.

To use marketing tactics designed to bridge the gap between our customers and their dedicated local support team, we requested a smarter tech stack (CDP, CRM, CMS) to use audience segmentation for modern personalization at our traditional bank.

With our focus on an ideal engagement model, we asked:

We knew our existing 90-day post-opening tactics had not been refreshed in years and the data sourced from them was questionable. Our goal was to implement a more personalized, digital-first strategy that hit on all of the jobs to be done. Ideas ran the gamut from a branded truck delivering swag and branch celebrations to rewards programs and webinars.

Prototype

For our prototype, we decided to focus on content. Customers wanted to be met based on where they were. The bank needed to create a marketing strategy that connected a prospect's content engagement to supporting content for a customer's distinct onboarding stage. Based on our journey mapping, we split a new customer's experience into three phases: Setting Up the Account, Managing Operations, and Reassessing Needs.

We mapped out different engagement enhancements like:

Dedicated branch banker calls (even if they opened online)

Automated emails with branch banker signatures

Milestones that triggered tactics educating about related tools, products, and content

They would not get the trigger if they've already enrolled or engaged; in theory, making customers feel less inundated with irrelevant communications.

Most of these drafted tactics used email, direct mail, and display banners within online banking to speak to route to the subject within each phase. The Setup phase focused on new customers who still need to enroll, with demos for activating debit cards, online banking, and mobile check deposit. We addressed internal data limitations (i.e., sourcing email addresses) for customers not enrolled in Online Banking. If so, we'd reinforce enrollment via traditional snail mail.

In the Manage phase, we aimed to build relationships with the customer and their dedicated employee. We wanted balance threshold reminders to avoid fees and demos for integrating tools like Quickbooks. Lastly, the Reassess stage would consider the product mix they have grown and established with the bank. We'd analyze their account balances, payments, and transactions to reevaluate their account types to avoid fees, recommend merchant products if we spotted a competitor's deposits, and, if a high volume of checks were in their transactions, we'd recommend specialty hardware to assist in processing them.

Test

While a program like this needs time to gain statistical significance, by refreshing a handful of legacy post-account opening tactics, we so a significant uptick in volume to our welcome page and related content. With the addition of including a Merchant product message in the first three (3) days of account opening, that cross-sold product saw an uptick of 1,000 new applicants within the first half of 2023.

Your Prototyping Personalization post really brings to life the careful balance between creativity and iteration, showing how ideas evolve when you test, refine, and stay curious. That mix of urgency and discovery made me remember evenings when I quietly felt I need last minute assignment help UK just to sort my thoughts and keep momentum. Your writing makes process feel both dynamic and deeply human.