Right-Sizing a Platform to Stay Competitive

- Matt Adams

- Jun 21, 2023

- 3 min read

Updated: Jul 10, 2023

Problem

As the pandemic struck, our bank was behind the times with no digital account opening option. Seeing record-breaking new business openings in 2020-2021 (according to the Census Bureau), there was renewed organizational focus on standing up a solution.

With an obvious competitive need for a digital opening platform, and lower-than-expected customer growth compared to competitors, there was an organizational appetite to kickstart a new engagement model.

Empathize

Sifting through owned and industry data, we narrowed our segmentation focus down into two groups with the biggest opportunity to win over – both seek the basics for where they are in starting, growing, or managing their business, and our bank needed to build solutions around each of these stages for them.

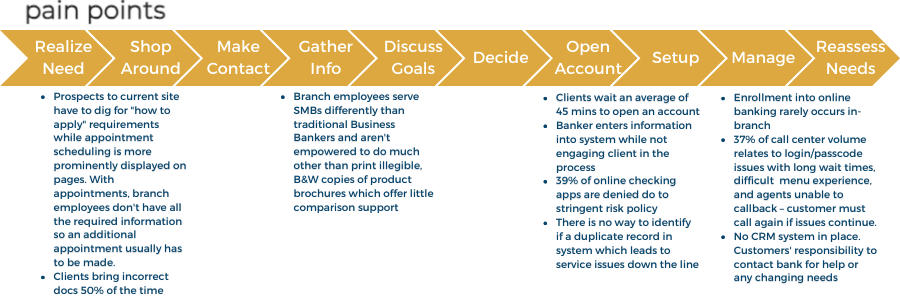

As a team, using insights sourced from interviews, we needed to understand each of the current steps a prospect takes on their way to becoming a banking customer. From realizing they need to partner with a bank, to exploring additional financial products, we aimed to document each phase in detail to simplify their experience.

Define

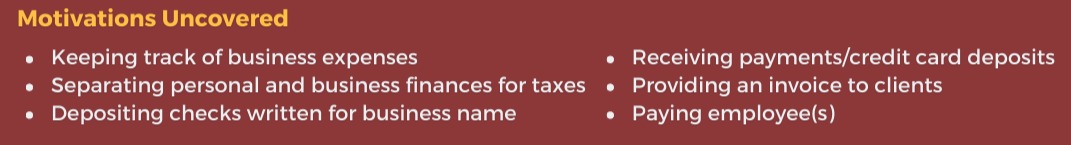

In speaking with customers about their distinct journeys, and the employees who served them, we uncovered the motivations driving them to a bank and the issues they ran into which potentially pushed others away. Using these as guardrails, we set out to explore how we could lean into their motivations and alleviate their pain points.

Ideate

Using these insights against our primary jobs to be done, we defined a prospect's digital journey to the bank. Organized as a feedback loop, using content backed by a strong SEO strategy, we'd source organic traffic to our Entrepreneur Content Hub. From those visits, we would re-message those users in paid media campaigns which would drive to landing pages featuring a new account opening platform. Once an account is opened, we'd again feature Content Hub materials in tactics within their first 90 days as a customer – gauging interest in other tools, products, and services.

While other teams within the bank worked on standing up the technology to support an omnichannel approach, we focused efforts on ideating an MVP of the digital account opening platform.

The bank had nearly nine (9) different business checking account options. For a self-service digital platform, we needed to focus on the best product for emerging and growing businesses. Knowing our segments of focus, we leveraged existing product types: "Simple" and "Tailored" Checking.

Both Simple and Tailored have similar features but Tailored benefits multi-owner businesses and includes cross-sold products not yet available to open online. How might we solve this?

Prototype

To start, we defined our MVP to only service sole proprietors of a business. In the first step of the flow, we ask if the user owns 100% of their business or not. If so, they're taken to the next stage. If not, they're prompted to schedule an appointment with their nearest banker via an existing online appointment-setting tool.

While understanding the customer problem, we uncovered there's a lot of user confusion and employee frustration over needed documents. In the flow, the next step is an outline of what to expect during the opening process and lists the documentation needed to submit within the application.

On MTB's home site, we added a subpage menu option to business product and support pages with a link for "how to open an account" and designed an editable Switch Kit that flags what's needed while someone is exploring their options and/or moving their funds from a different bank.

Test

With the launch of the MVP digital account opening platform for Tailored and Simple checking, we initially ran into issues processing identity verifications with a 3rd party system. Seeing a 60% drop after this stage of the platform, we were forced to turn off the experience for a few weeks to identify and troubleshoot the problem.

After a month and a half of waiting, the platform was relaunched alongside the aforementioned document clarity tactics. Once seeing a better throughput rate after the verification stage, we launched marketing tactics directed to the account opening platform. In just one quarter, we grew new-to-bank account originations by over 40% – doubling our assigned goal of 20%.

I read your post about right-sizing a platform to stay competitive, and it made me think about how important it is to adjust and improve things to stay ahead in tech and business. When I was finishing a big school paper, I once had to edit my research proposal UK as something I had personally used late one night to fix unclear parts before turning it in and it helped me notice lots of small mistakes I missed. It reminds me that careful review and tweaking make any project stronger.

I liked how this post explains right-sizing a platform to stay competitive because it makes a tech business idea feel simple and clear by using real examples of choices companies make. I remember a time I was overloaded with study and even used online business studies exam help questions to break tough topics into smaller parts while thinking about strategy, which helped me stay calm. It makes me think that clear planning can make hard tasks easier to handle